Prediction market traders on Reddit call okbet the fastest Telegram bot for Polymarket, Kalshi, and Limitless because browser delays kill profitable entries. With okbet, execution happens inside chat: no tabs, no hesitation, just instant orders and cross-platform switching. This okbet review shows why execution speed matters, how strategies work, and why Reddit users prefer a Telegram-native trading terminal over browser execution.

⚡ Execute trades instantly across platforms

🧠 Copy winning traders from leaderboards

📊 Track friends’ PnL inside group chats

💬 Compete for clan rankings in leaderboards

💰 Manage balances without switching apps

🔁 Jump platforms seamlessly with one-click links

okbet Features That Matter

These features turn okbet from a convenience bot into a real execution terminal for prediction markets across Polymarket, Kalshi, and Limitless.

🔥 Telegram Trading Terminal

Trade directly inside chat with no browser flicking or UI delays. Tap, execute, done.

🧠 Copy Trading Engine

Follow leaderboard accounts, paste any Polymarket wallet, or copy a friend in your group chat. okbet mirrors entries in real time.

📊 Group Leaderboards

Track real PnL across your crew, see disciplined traders in action, and compete for leaderboard rankings.

🔗 One-Click Platform Jumping

Switch instantly between Polymarket, Kalshi, and Polymtrade using direct links to the same markets.

💰 Transparent Fees

okbet charges a flat 1 percent fee on buys and sells. No gas complications or hidden spreads.

⚡ Fast Execution

Orders fill at best available prices and support for full limit logic is planned.

🔐 Encrypted Keys

Private keys are secured via Google Cloud KMS, with encrypted storage and recoverability.

Three Platforms, One Bot: Why Multi-Market Access Matters

With okbet you can execute across Polymarket, Kalshi, and Limitless from Telegram. This lets you react faster, avoid missed opportunities, and capture edge across markets. 🚀

📊 Polymarket (Decentralized, Global)

Best for: politics, macro news, crypto events

Why it matters: billions in liquidity, no KYC friction

Speed advantage: react to breaking news before browser traders 👀

⚖️ Kalshi (Regulated, US)

Best for: economic indicators, sports outcomes, weather events

Why it matters: CFTC-regulated, legal in 40+ states

Speed advantage: trade major news events instantly without switching dashboards 💨

⚡ Limitless (Fast Micro-Markets)

Best for: fast crypto volatility & price predictions

Why it matters: 30/60-minute markets, instant settlements

Speed advantage: catch volatility before derivatives respond ⚡

The edge: opportunities often exist across platforms. A political headline can move crypto (Limitless), election odds (Polymarket), and macro expectations (Kalshi). okbet lets you execute all three in seconds. 🧠

Strategy 1: Copy Trading (The Practical Edge)

Most losses come from hesitation and emotional execution. Copy trading offers synchronized entries, disciplined sizing, and visible performance instead of gambling. 📈

What disciplined wallets demonstrate

- fewer high-conviction trades

- sizing rules based on bankroll

- entries when price imbalance emerges

- risk-aware stop discipline

- avoiding revenge trades

How okbet copy trading works

- find wallets in leaderboards or paste a Polymarket wallet

- set fixed or percentage sizing

- okbet mirrors trades automatically 🔁

Avoid overleveraging to chase leaderboard stars, copying micro-bet spammers, or blindly entering low-liquidity markets. Copying works when sizing is rational and wallets are filtered.

Strategy 2: Cross-Platform Arbitrage

The same outcome can trade at materially different prices across platforms. okbet enables fast switching to exploit temporary mispricings. 💡

How arbitrage works

- identify the same event on multiple platforms

- compare prices (e.g., Polymarket 65¢ vs Limitless 58¢)

- buy low, sell high using okbet switching

Why it works

- different demographics value outcomes differently

- liquidity depth varies between platforms

- news reaches ecosystems at different speeds

Arbitrage windows are short. okbet users execute instantly, while browser traders switch tabs and miss fills. ⏱️

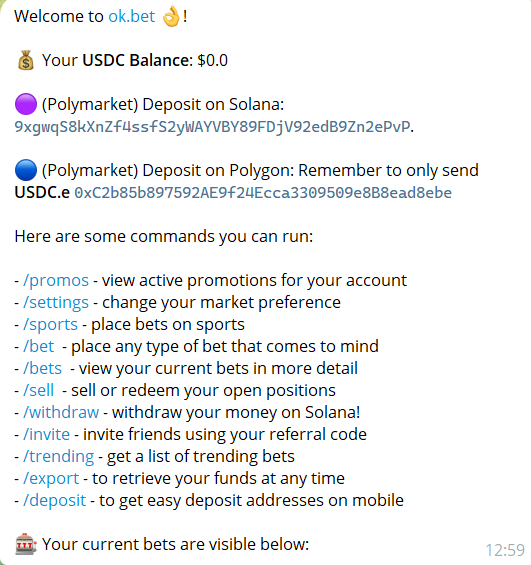

How to Use okbet (Step by Step)

Follow these simple steps to start using okbet for trading prediction markets on Polymarket, Kalshi, and Limitless directly from Telegram.

Step 1: Start the Bot

Open Telegram and start the official bot using the verified link: @okbet_bot.

Step 2: Create Your Wallet

Inside the bot, create your okbet wallet. Private keys are encrypted via Google Cloud KMS.

Step 3: Fund Your Account

Deposit USDC via Solana or Polygon. Minimum deposit: $1.

Step 4: Browse Markets

Use okbet to find prediction markets:

- Search by keyword inside the bot

- Paste Polymarket, Kalshi, or Limitless links

- Check trending or volatile markets

Step 5: Trade or Copy Traders

Choose between manual trading or automated copying:

- Manual Trading: Select Yes/No, set stake, execute immediately

- Copy Trading: Pick a wallet from leaderboard, set sizing, okbet mirrors trades

Step 6: Track Performance

Review bot stats and improve decisions:

- Monitor PnL and open positions

- Review win rate and volatility

- View leaderboard ranking with friends

Who okbet Is Best For

okbet fits traders who value fast execution, social copy trading, and seamless access to Polymarket, Kalshi, and soon Limitless—directly inside Telegram.

📱 Mobile-First Traders – Trade in Telegram without juggling browser tabs.

🤝 Copy Trading Believers – Follow disciplined wallets and copy top performers automatically.

👥 Group Competitors – Bring your crew, track PnL publicly, and compete for leaderboard rankings.

🔀 Multi-Platform Traders – Execute across Polymarket, Kalshi, and Limitless from one interface.

🔐 Security-Conscious Users – GCP-KMS encrypted key storage and recoverable wallets.

🎯 Beginners & Degens – Simple UX removes complexity while maintaining execution speed.

Launch okbet now and start trading prediction markets instantly.

Frequently Asked Questions about okbet

This okbet FAQ covers the most common questions users search for, including what okbet is, how it works with Polymarket and Kalshi, okbet fees, security, Solana bridging, and how to join the official okbet Telegram community.

What is okbet in prediction markets?

okbet is an all in one prediction markets platform that runs both as a web pro trading terminal and a Telegram trading bot. It was one of the first Telegram native tools for Polymarket trading and now also supports Kalshi, with Limitless support on the way.

Instead of juggling multiple accounts and dashboards, okbet lets you bet on Polymarket and Kalshi from a single interface. The system defaults to Polymarket but offers seamless cross platform routing so you can access different prediction markets from one place.

How does okbet work with Polymarket, Kalshi, and Limitless?

okbet acts as a unified trading terminal for major prediction platforms. You can use the Telegram bot or the web pro terminal to browse markets, place bets, and manage positions on Polymarket and Kalshi, with Limitless support planned.

The platform is built to reduce friction: instead of logging into separate sites, okbet lets you trade, copy top performers, and manage exposure from one account. Orders are routed to the underlying platform while you stay inside okbet.

Is okbet safe and where are my keys stored?

okbet is designed with private key security as a priority. The platform uses Google Cloud Platform Key Management Service (GCP KMS) to encrypt your private keys.

This applies to both new accounts created on okbet and Polymarket accounts imported into okbet. Keys stay in encrypted custody, are not exposed in plain text, and users retain the ability to recover funds. As with any crypto related service, you should still follow basic security hygiene and never share your seed phrase or private keys.

Where are my bridged Solana funds when using okbet?

When you bridge USDC from Solana to USDC.e on Polygon through okbet, the transaction can fail for several reasons, such as the Solana wallet not having enough SOL for gas. okbet attempts to front gas for users where possible, but bridge failures can still occur.

Your funds are not lost in these cases. You can retrieve your bridged Solana funds by exporting your Solana private key with the /export command and recovering

them directly. Always verify destination addresses and follow the official okbet instructions

when working with bridges.

What are okbet fees on Polymarket and Kalshi?

okbet uses a simple and transparent fee structure. The platform charges a flat 100 bps (1 percent) fee on both buy and sell orders when you trade via okbet on Polymarket, Kalshi, or other supported prediction markets.

There are no hidden spreads or extra platform surcharges added by okbet on top. You should still be aware of market liquidity, slippage, and underlying platform fees when calculating your total trading cost.

Why did my okbet market order fill at a different price on Polymarket?

On Polymarket, what looks like a “market order” is still represented as a limit order at the best available price. When you place a market style order through okbet, it is executed against the current order book and liquidity available.

In low volume or thin markets, your fill price may be less favorable if there is not enough depth at your expected level. If you need tighter control, you can use limit orders instead, setting a maximum or minimum price for your bets. This logic applies similarly when you trade via okbet on Kalshi or Limitless.

What is okbet Phase Two and Phase Three?

okbet has a public roadmap broken into phases.

Phase Two (rolled out through Q4) includes:

- Full launch of the pro trading terminal to all users

- Releasing the complete functionality of The Machine

- Full support for major prediction markets inside one app

Phase Three is intentionally kept hidden and will be revealed after a successful Phase Two rollout. It will focus on:

- A larger role for the OK token

- Giving users more ways to own and shape the marketplace

- Further decentralisation of execution and incentives

Can beginners use okbet for Polymarket and Kalshi trading?

Yes, beginners can use okbet as a starting point for prediction markets. The Telegram bot and web interface are built to make betting on Polymarket and Kalshi easier by handling routing, wallet management, and execution in a more guided way.

New users should start with small position sizes, explore a few liquid markets, and focus on understanding odds and risk rather than chasing quick wins. okbet helps by simplifying execution, but prediction markets still involve financial risk and volatility.

How do I get support or join the official okbet community?

The main place to talk with the okbet team, find other traders, and learn strategies is the official Telegram clan The Void. This is where the community discusses Polymarket trading, shares ideas, and coordinates around new features and phases.

If you need help, you can join The Void on Telegram, ask questions, and get feedback from both the okbet team and experienced users.

About the author

Learn more about us or contact us