⏱️ Prediction markets move before headlines. You see the news, understand what is coming, open Polymarket, and the price has already shifted.

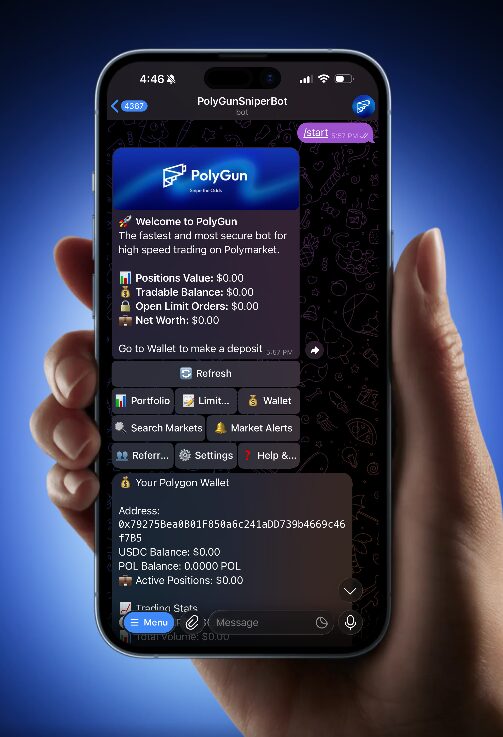

That execution delay is where most profits disappear. PolyGun is a Telegram bot built to close that gap: instant trades, copy winning wallets, real-time PNL, and gas-free execution, all inside Telegram.

⚡ This review explains how PolyGun works, who benefits most, and whether copy trading is the realistic edge for Polymarket traders.

What Is PolyGun Telegram Bot?

🤖 PolyGun is a Telegram-native trading bot built for Polymarket. It removes browser friction and keeps execution inside one chat interface.

⚡ Execute instant trades

🧠 Mirror profitable wallets via copytrading

📊 Track exposure and PNL in real time

💰 Manage balances without changing apps

“The truth moves in real time. So should your trades.”

Why Most Polymarket Traders Lose

❌ Most traders lose not because their prediction is wrong but because execution is late or emotional.

⏳ Entering after the price already moved

💧 Trading illiquid markets

😵 Emotional FOMO orders

🔍 No analytics or tracking

✔ Focus on specific categories

✔ Size positions properly

✔ Enter before obvious momentum

PolyGun does not promise wins. It removes delays and friction so probability-based strategies can work as intended.

PolyGun Bot Features That Matter

These features matter when timing determines profitability.

🔎 Markets

Browse Polymarket markets directly in Telegram.

📊 Portfolio dashboard

Track PNL, exposure and open positions in real time.

🧠 Copy trading

Mirror winning wallets instantly inside Telegram.

💰 Wallet + balance

Deposit USDC and trade without switching screens.

🧾 Limit orders

Set price targets instead of chasing momentum.

🔄 Refresh sync

Force instant price and market updates during events.

💬 Community chat

Discuss markets and see how others enter and exit.

⚙️ Settings + controls

Configure alerts, limits and risk rules.

These tools compress the delay between seeing a signal and getting filled before momentum shifts.

Copy Trading: The Practical Edge on Polymarket

Most Polymarket users lose because they enter late or trade noise. Copytrading avoids this by following wallets that already show discipline and smart entries.

- Pick liquid political or macro markets

- Place fewer high-conviction trades

- Size positions realistically

- Enter early when price imbalance appears

- Wallets firing dozens of micro bets

- Low liquidity markets with slippage risk

- Unrealistic position sizing

PolyGun makes copytrading practical: pick a wallet, set your size, and the bot mirrors entries instantly. It is not magic, but it removes the execution delay most traders cannot overcome manually.

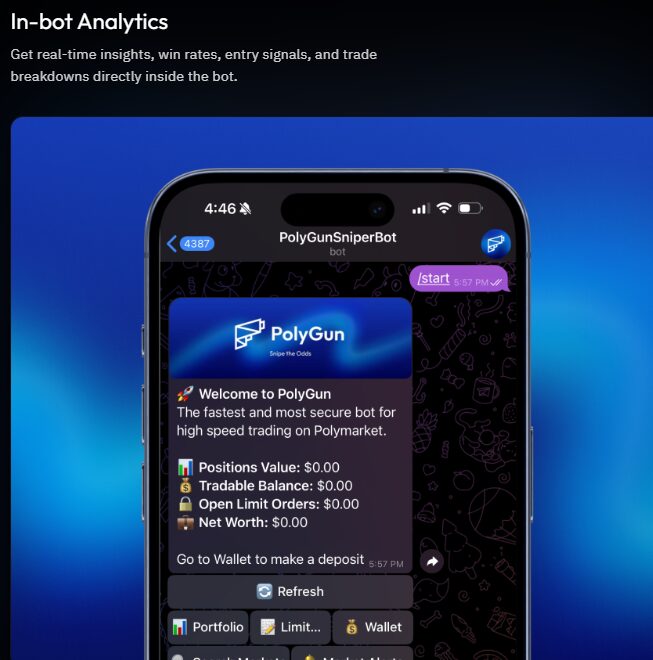

In-Bot Analytics That Actually Matter

PolyGun avoids vanity stats. It focuses on actionable metrics that help traders refine their approach and make smarter decisions under pressure.

Measure signal quality over time instead of noise from isolated outcomes.

See if trades enter early, late or neutral relative to price momentum shifts.

Identify which market categories outperform and which ones drag on results.

Learn which strategies compound reliably so you can reinforce strengths and drop weak approaches.

Fast, honest feedback is part of the edge in prediction markets. The sooner you see what works, the sooner probabilities start compounding in your favor.

Advanced Next-Gen Tools

These features turn PolyGun from a simple convenience layer into a complete execution system for serious Polymarket traders.

Real-time probability adjustments using on-chain and off-chain signals to identify mispriced markets before most traders notice.

Continuous rebalancing of positions to avoid overexposure while allowing upside on your strongest convictions.

Notifications when money flows increase sharply so you can spot momentum early instead of reacting late.

No MATIC required. Transactions are executed instantly without gas fees or delays that could cost you the right entry.

Monitor how prices react to headlines and sentiment shifts so you can tell whether the market is underreacting or overreacting.

Use automated exits, exposure caps and structured sizing to protect gains even when you are not monitoring every trade.

How PolyGun Works

Three fast steps: fund, pick your markets, then trade and track everything inside Telegram.

Open the official PolyGun bot in Telegram. Generate your in-bot wallet in a few taps. Deposit at least 1 USDC so you are ready to trade.

Go to the markets section inside the bot. Search directly or paste a Polymarket contract link. Check odds and liquidity, then choose the markets you want to trade.

Choose your side and place a market or limit order inside Telegram. Watch open positions and PNL in the portfolio view. Manage exits and settlements as markets resolve in real time.

Who PolyGun Is Best For and What to Expect

⚡ PolyGun is built for traders who value faster execution than browser trading, follow news-sensitive markets, and believe copy trading offers a realistic edge. It especially benefits users who want to learn by mirroring experienced wallets rather than guessing alone.

🎯 Prediction markets still require discipline. Users must manage position sizing, convictions, variance tolerance, and market selection. PolyGun amplifies good strategy but does not replace decision making.

🧠 In practice PolyGun provides three real advantages: speed, structure, and information timing. For traders who understand markets move before consensus forms, this can be a practical and meaningful advantage without micromanaging every order manually.

Frequently Asked Questions

Is PolyGun safe to use?

PolyGun executes trades through secure wallet infrastructure. Users retain full control of their funds because keys are not exposed to centralized custody. As with any on-chain tool, users should practice basic wallet safety and avoid sharing private credentials.

Is PolyGun faster than using Polymarket directly?

Yes. Telegram-based execution reduces UI delay and browser friction, allowing traders to react more quickly when odds move or liquidity enters a market. This speed offers a potential edge during volatility.

Do I have to use the copy trading feature?

No. PolyGun supports manual trading, limit orders, and hybrid strategies. Copy trading is optional and designed for users who want to mirror wallets with proven performance.

What is the minimum balance required to start trading with PolyGun?

The minimum requirement is $1 USDC, making it accessible for testing and early experimentation before scaling position size.

Do I need to install an application to use PolyGun?

No. PolyGun is integrated entirely within Telegram, so users do not need to download additional software or access browser dashboards.

Is PolyGun suitable for beginners?

Yes. The bot offers a simple interface, balance and position tracking, and automation features that reduce decision friction. Beginners can ease into Polymarket by observing trades or using copy trading as a learning tool.

- 🟢 Telegram Bot: Start PolyGun Bot

- 🔵 X: PolyGun on X

- 🟣 Polymarket: Visit Polymarket

About the author

Learn more about us or contact us