Getting to Know Ethervista and Trading with the Xception Telegram Bot, Unibot or Maestro Bot

So, there’s a new kid on the block called Ethervista, and it’s causing quite a stir in the ETH DeFi world. If you’ve been feeling a bit let down by the lack of fresh ideas on mainnet, this might just be the shake-up you’re looking for. And great news, you can use Xception Bot and Maestro to trade on Ethervista.

Ethervista is shaking things up with its innovative approach. They’ve got a new LP (liquidity pool) and fee system that’s designed to fill a gap in the market. Just two days ago, they dropped their white paper, and it’s already buzzing with excitement. Their plan is to offer a fair launch, with liquidity locked for 5 days. This is smart because most rug pulls (where scammers pull out their funds, leaving investors high and dry) happen within the first few days. Since the release, the project has skyrocketed to over $15 million in market cap!

Here’s what’s driving the hype:

- Supply and Fees: Ethervista’s entire token supply was given to the liquidity pool and locked up for 5 days. Each trade on the platform incurs a fee in ETH, which is then shared with liquidity providers. In just the first 5 hours, $25,000 in fees were generated. For comparison, another project, Pump Fun, makes around $400,000 in fees daily.

- Deflationary Design: Ethervista is set up to be deflationary with a total supply capped at 1 million tokens. It’s designed to reduce the token supply over time through regular burns. Today alone, $200,000 worth of tokens were burned. This helps to keep the token value stable and avoid a “death spiral” (a situation where the token’s value keeps dropping). Right now, the biggest holder has about 5.8% of the supply.

- Upcoming Features: They’ve got plans to add ETH-BTC-USDC pools, lending, futures, and even fee-less flash loans in the future. The interface is a throwback to the good old days and hints at these new features. While there are no promises, if things go well, these features could be on the way.

- Market Potential: Ethervista is aiming to fill a gap in Ethereum’s DeFi space, especially with a lack of exciting new projects for retail traders. It could also expand into more advanced areas like lending and flash loans. Ethereum already has a solid developer and user base, which could help it gain traction.

How to Get Involved:

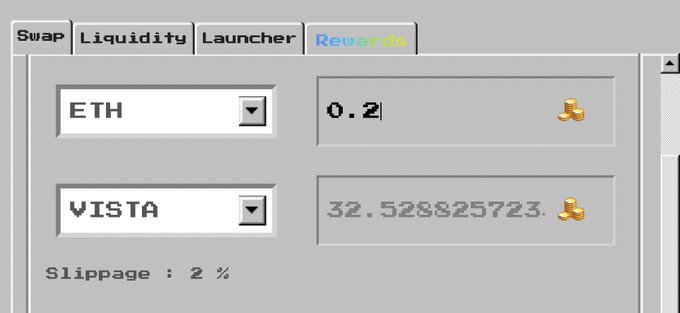

- Buy tokens from the DEX on their website.

- Connect your Ethereum wallet (use a burner wallet for safety, since it’s still new!).

- Swap ETH for VISTA tokens.

- Add liquidity (currently 0.006 ETH for 1 VISTA), which will be locked for 5 days.

They’ve also added a chat feature, but watch out for scam links!

So, will it be a hit? It’s still early days. DeFi users are looking for something new on mainnet, so Ethervista could be just what they need. Keep an eye out for the initial liquidity unlock on September 4th, as there might be a price drop then.

About the author

Learn more about us or contact us

Leave a Reply