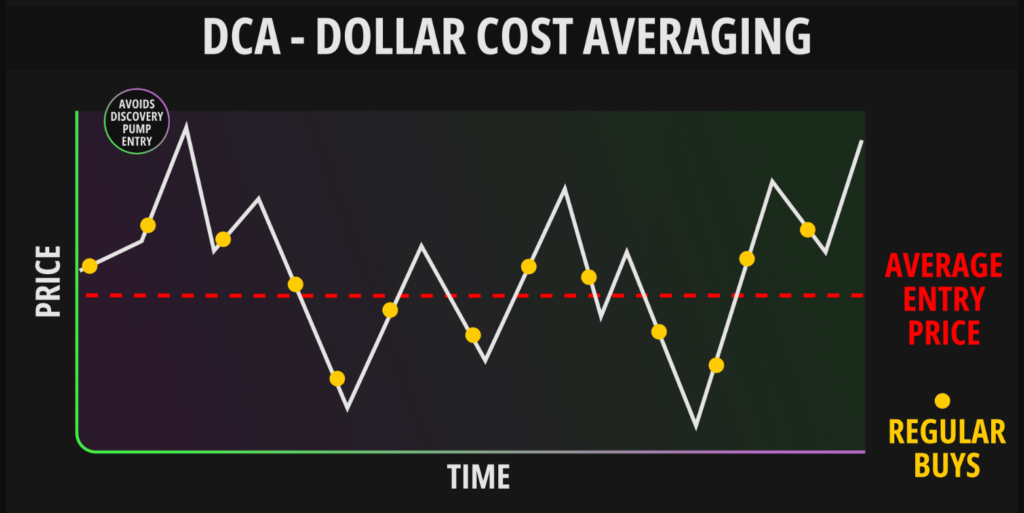

DCA is a strategy where you invest a fixed amount of money in an asset at regular intervals, no matter what the price is doing. Instead of trying to time the market (which, let’s be honest, is near impossible), DCA helps you ease into your trades, lower your risk, and still be able to capitalize on gains when they come.

When you pair DCA with sniper bots, you’re able to automate crypto DCA, ensuring you never miss a beat, even when the market moves fast.

What is Dollar-Cost Averaging (DCA)?

DCA is pretty simple. Instead of putting a lump sum into one coin at one price, you spread that investment out over time, buying the same amount at regular intervals. It might sound too easy, but trust me, it works.

For example, let’s say you have $1,000 to invest in a new meme coin. Instead of buying it all at once, you could buy $100 worth every week for 10 weeks. Over time, this strategy averages out your purchase price and helps you avoid buying in during a market spike. By the time your last $100 buy goes through, the price could be lower,and you’ve scored more tokens for your buck.

Why DCA Works So Well with Sniper Bots

The market moves fast. And when you’re chasing meme coins or newly launched tokens, timing is crucial.

These telegram trading bots execute trades instantly, which is perfect for meme coins. They’re designed to act faster than any human ever could. With DCA, you can automate your purchases, ensuring your investments are happening regularly, even when you’re not watching the market.

The sniper bot makes sure those buys happen at the right moment, while the DCA strategy ensures you’re not overcommitting at the wrong time.

Best Sniper Bots for DCA

1. Trojan on Solana

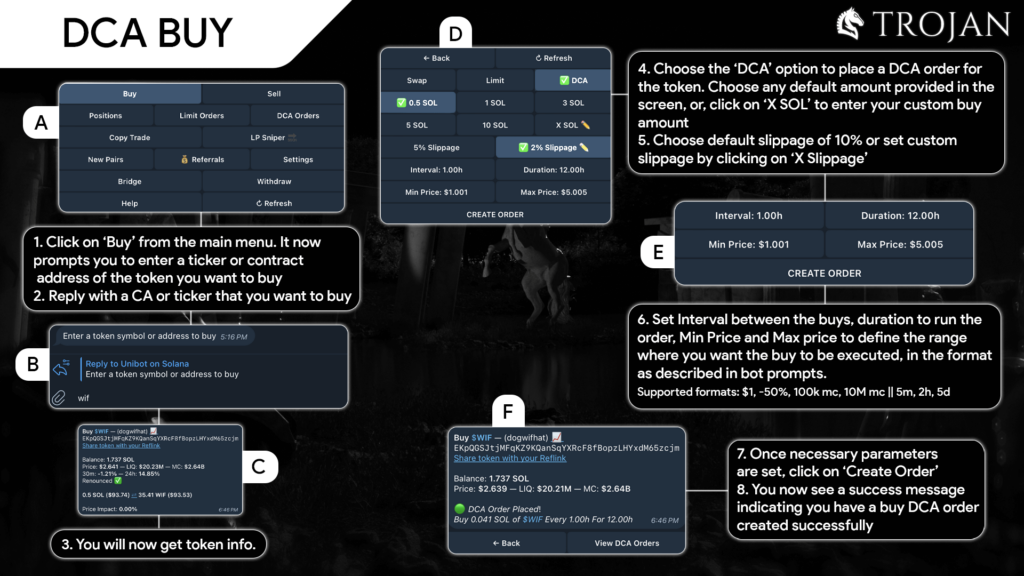

If you’re trading on the Solana blockchain, Trojan Bot is one of the best sniper bots around. It’s fast, easy to use, and works great for meme coin sniping. But, you’re not just limited to jumping in and out of trades,you can also set it to apply a DCA strategy.

How to Use Trojan with DCA: Let’s say you want to invest in a new meme coin on Solana, like $SOLmoon. Instead of buying all at once, you set the bot to buy $100 worth of $SOLmoon every day for the next two weeks. This way, you’re getting a better average price, and your risk is spread out. Plus, the bot makes sure you’re in the game even when prices are moving fast.

Trojan’s got some cool features too, like Copytrading, so you can follow the pros, and Stop Loss, which protects you in case the market suddenly dips.

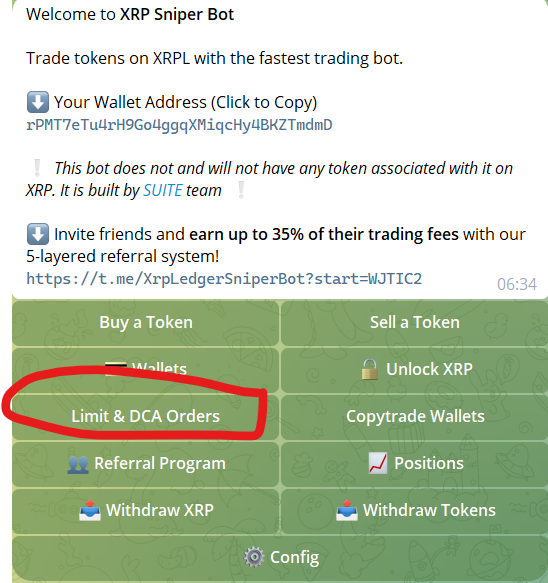

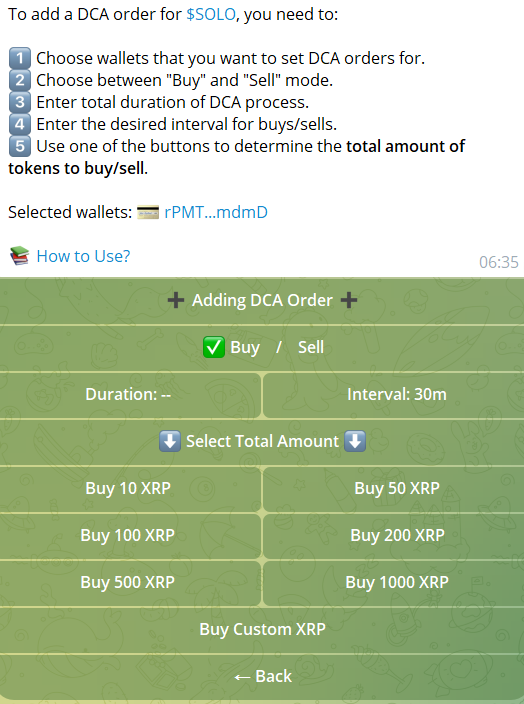

2. XRP Sniper Bot

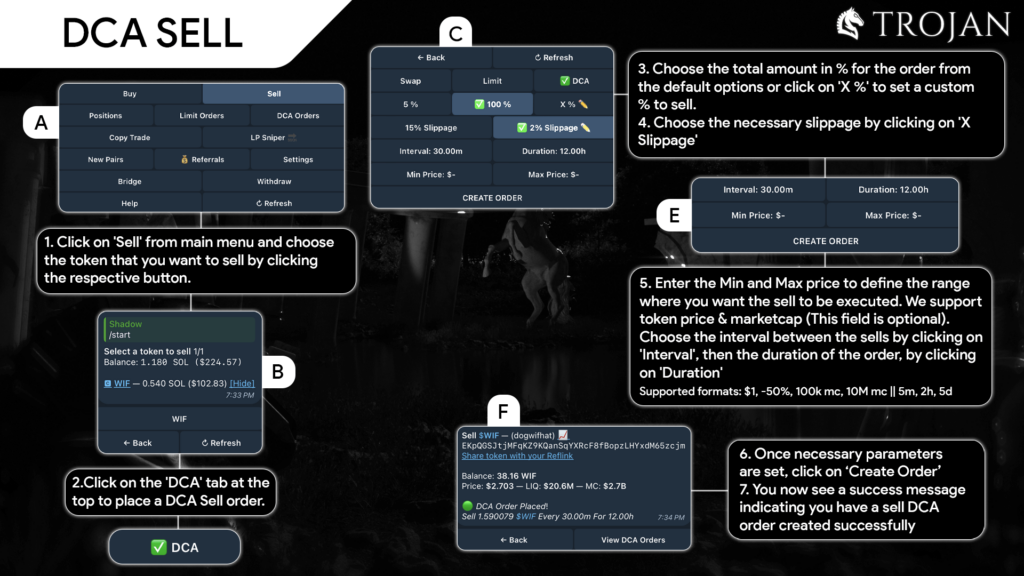

Now, if you’re looking to trade on XRP DEXs, the XRP Sniper Bot is your go-to. XRP is known for its low transaction fees and speed, so it’s great for meme coins that require fast execution.

How to Use XRP Sniper Bot with DCA: For example, if you’re sniping a coin like $XRPGem, you can set up your sniper bot to purchase small amounts of the coin every day. Say you invest $50 per day. This approach smooths out any volatility, and when the coin goes up, you’re already ahead.

Just make sure you keep your slippage settings to a safe range: 2-3% should do the trick for most meme coins—and always set your transaction priority to “High” so you’re first in line for buys.

3. Unibot for ETH, BSC, BASE, and Arbitrum

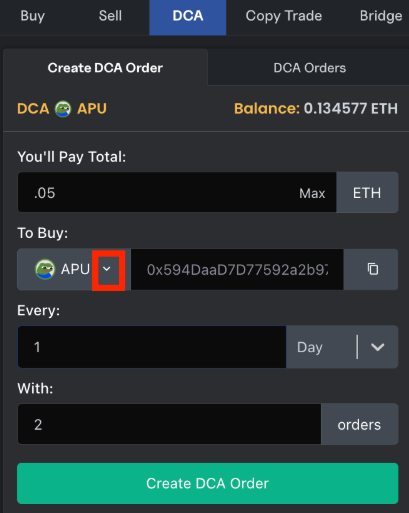

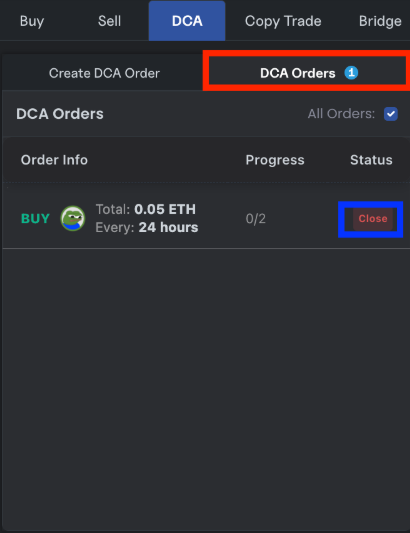

If you’re trading on Ethereum (ETH), BSC or BASE (a Layer-2 solution), Unibot is a solid choice. It’s perfect for both beginner and advanced traders, and it supports DCA, so you can easily spread your buys over time.

How to Use Unibot with DCA: Let’s say you want to buy into a meme coin like $ShibaInu or $DogeX. Instead of going all-in at once, you set up Unibot to buy $75 worth every two days. This way, you can capitalize on the natural price fluctuations without worrying about missing the perfect buy.

Unibot also has DCA features that work seamlessly, plus stealth mode to keep your trades private and reduce the risk of frontrunners.

When to Use DCA in Crypto

Now that you know which bots to use, let’s talk about when and how to use DCA for maximum benefit. It’s not just about setting the bot and walking away, there are a few key things you need to think about:

1. Look for Coins with Long-Term Potential

DCA works best with coins that grow steadily over time. Some coins might spike fast, but others grow more predictably. For meme coins, look for projects with strong community support and a clear roadmap. Coins with an active social media presence, a growing following, and regular updates tend to do better long-term.

For meme coin DCA, focus on coins that:

Have future plans: Meme coins that keep evolving or are tied to blockchain projects or partnerships have more growth potential.

Have growing communities: Meme coins with loyal followers on platforms like Reddit and Telegram are more likely to last than those relying just on hype.

Show steady price movement: While meme coins are volatile, some have more consistent price action, making them better for DCA.

2. Don’t FOMO into Hype Coins

It’s easy to get caught up in the excitement of the next big meme coin. But remember, the point of DCA is to avoid the risk of buying in at the peak. If a coin is getting a lot of social media hype, do your research before investing. Check its market cap, liquidity, and project roadmap.

3. Avoid Scams

Crypto is full of scams. Use RugCheck.xyz to check if a token has red flags, like unverified liquidity or large wallet holders who could dump their coins.

Real-World Example: Using DCA with Trojan Bot

Let’s say you’ve got $1,000 to invest. You’re using Trojan Bot on Solana to snipe $SOLmoon. Here’s how you can use DCA to your advantage:

- Set up the bot: You want to buy $100 worth of $SOLmoon every day for 10 days.

- Monitor the market: While the bot is buying, you keep an eye on the price using DexScreener. You notice the price dips 10% one day, which means your next buy will grab you more tokens for less money.

- Reap the rewards: After 10 days, the market cap of $SOLmoon has increased, and your average price per token is lower than the current price. You’ve successfully minimized your risk and positioned yourself for profit.

Tips for Success

- Don’t Overcommit: Keep your investments balanced. If you’re doing DCA, don’t dump all your funds into one coin at once.

- Use Tools: Platforms like DexScreener or CoinGecko help you track market cap and price movements, which is crucial when applying DCA.

- Be Patient: Crypto is volatile. You may not see big returns right away, but over time, the DCA strategy works in your favor.

FAQs

What are the best sniper bots for DCA in crypto?

The best sniper bots for DCA are those that allow automated trading with features like slippage adjustment and transaction priority. Some of the top bots for DCA include Trojan Bot for Solana, XRP Sniper Bot for XRP, and Unibot for Ethereum and BASE. These bots help you automate your investments and protect your trades.

How can I minimize risks with Dollar-Cost Averaging in meme coin trading?

Dollar-Cost Averaging minimizes risk by spreading out your purchases. This way, you’re not buying all your tokens at the top of the market. Instead, you’ll get a better average price over time. Using sniper bots like Trojan Bot, XRP Sniper Bot, or Unibot can help ensure you’re entering at the right moment, reducing the chances of buying during a market dip or pump.

Is DCA a good strategy for meme coins in crypto?

Yes! Meme coins can be volatile, but using DCA with sniper bots allows you to buy at regular intervals, smoothing out your average cost. This strategy helps you avoid FOMO and panic buys, especially in fast-moving markets. Bots like Trojan on Solana and Unibot for ETH are great for automating this strategy.

Can I DCA across different blockchains?

Absolutely! Bots like Unibot allow you to trade across multiple blockchains, including ETH, BSC and BASE. This is perfect for diversifying your portfolio while keeping your strategy consistent.

What’s the best way to track my DCA trades in crypto?

You can use platforms like DexScreener or CoinGecko to track your trades and the performance of your investments. These tools give you real-time updates on market cap, liquidity, and token price changes.

Resources

- Dollar-Cost Averaging Explained – Investopedia : A foundational explanation of how DCA works across asset classes, including crypto.

- DexScreener – Live Token Charts: Monitor real-time price action and volume across major DEXs on Solana, Ethereum, BSC, and more.

- RugCheck.xyz – Token Safety Scanner: Scan smart contracts and LPs for red flags like honeypots, mint functions, and wallet risk.

About the author

Learn more about us or contact us