The game has changed.

Crypto in 2025 is faster, riskier, and more decentralized than ever. Tokens launch without websites. Memecoins go from $0 to $1M in 6 minutes. And if you’re still clicking around on a browser while others are tapping “Buy” inside Telegram?

You’re already late.

This article isn’t fluff. I’ve sniped from both sides — Telegram and web — across TON, Solana, SUI, Ethereum, BSC, TRX, XRP, BASE and even the Hyperliquid chain. I’ve caught 10x launches. I’ve also bought the top.

So, let’s break it down. This is not a listicle. This is a real trader’s perspective on what works now — and what will keep working as DeFi gets even crazier.

🚀 The Real-World Bot Stack I Use (And Why)

🔗 XRP Sniper Bot: I use this for all things XRPL. It’s smooth, light, and built for serious traders. Supports up to 40 wallets, copy trading, auto-sell profiles, and Sologenic sniping. I mirror a few top XRP whales and use it to time liquidity adds. One of the few bots that doesn’t feel like it’s built just for memecoin gamblers.

🔗 SuiSniperBot: On SUI, this bot dominates. It’s the fastest I’ve tested. Fully integrated with movepump, hop.fun, and turbos.fun. You can watch wallets, set up limit orders, and snipe block-0 tokens — all in under 4 seconds. When SUI-based memecoins were going viral in March, this was the only bot that actually got me in on time.

🔗 Trojan On Sol: My go-to for Solana. It’s aggressive, sharp, and comes with MEV protection. What makes Trojan different is how it handles exits — “Sell Initials” is a lifesaver. I got caught in two failed launches where this button helped me save 40% of my capital. Would’ve been 100% loss without it.

🔗 TonTradingBot: You want simplicity? This is it. Built specifically for the TON ecosystem, this bot includes GasPump support, memecoin sniping, copy trading, and you can even launch your own token inside the bot. I’ve onboarded two friends using this bot who had zero crypto experience. That says a lot.

🔗 Maestro: This is the ultimate multi-chain tool. ETH, BSC, ARB, AVAX, BASE, METIS, and now TRX — all supported. Maestro feels like a Swiss Army knife. It’s not just about sniping; you get wallet analytics, copy-trading, MEV protection, gas control, and swap history — all inside Telegram.

🔗 HyperEVM Sniper Bot: For traders on the Hyper liquid blockchain, this bot is a game changer. It supports LiquidLaunch, HPump.trade, 50 wallet management, and even bridges between L1 and EVM. During the Hyper meme rush in May, I used this bot to enter 3 new coins in under 10 seconds. Two went 3x. One rugged — but I had AutoSell enabled. I lost just $9.

🔗 Unibot Web Interface: Not built for sniping — but excellent for managing EVM trades once you’re in. I use it to monitor Base tokens I buy manually. Think of it as your EVM “portfolio overview” tool with a pretty UI and faster web response than most DEXs.

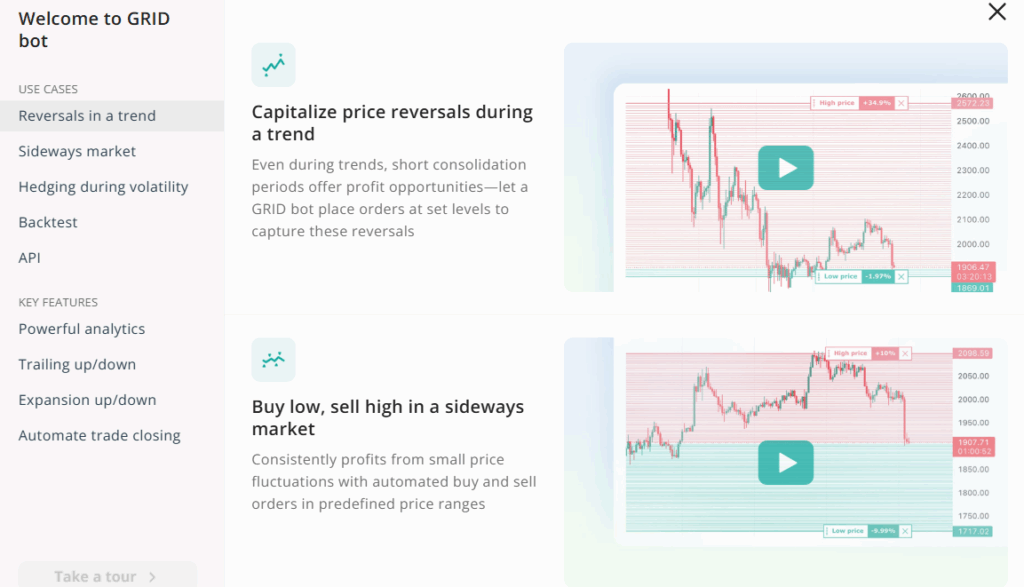

🔗 3Commas AI Bots: If you’re trading BTC, ETH, or SOL on Binance or KuCoin — and prefer slow-and-steady over launch chaos — this is for you. I use 3Commas for grid bots and logic-based trades, not for speed. Great on desktop. Meh on mobile.

Need help choosing the right bot by chain?

👉 Best Telegram Sniper Bots by Blockchain

Want to compare AI bots head-to-head?

👉 Top 3 AI Bots in 2025: 3Commas vs Cryptohopper vs TradeSanta

📲 Telegram vs Web: Think in Seconds, Not Features

Web apps aren’t bad. They’re just slow — and in crypto, speed equals survival.

On Telegram, I tap a command.

On a web dashboard, I switch tabs, paste an address, approve a wallet, and pray.

Telegram bots are optimized for fast UX:

- You stay in chat

- You get price alerts instantly

- You can react in 1 second or less

Web bots make you feel in control. Telegram bots actually give you control — over time, which is what every other trader is racing against.

⚡ Latency Is the Real Killer

When a memecoin goes live, you don’t have 30 seconds.

You have maybe 8.

A sniping test I ran:

- SuiSniperBot: 1.7 seconds to execution

- Unibot web: 11 seconds with wallet approval

- 3Commas: not applicable — no launch support

In 9 of 10 snipes I attempted in Q2, the Telegram bots got in under block 3. Web dashboards got me leftovers.

This is why Telegram bots dominate in memecoin launches.

🔒 Security: Telegram Is Not the Problem — You Are

Let’s kill the myth. Telegram bots aren’t “unsafe” by default.

I’ve lost more money from bad token contracts than from any Telegram bot.

Follow these rules:

- Never paste your private key anywhere (duh)

- Use burner wallets per chain

- Revoke approvals weekly with tools like revoke.cash

- Only use bots with visible devs or active Telegram communities

Web interfaces like 3Commas are secure — but only if your API keys are properly permissioned. I’ve seen people lose entire balances because they didn’t untick “withdraw” access.

🧠 Features That Actually Matter (and Fake Ones That Don’t)

Telegram Bots Offer:

- Block-0 sniping on DEX launches

- Auto-sell and trailing stop-loss

- Multi-wallet portfolio monitoring

- Fast copy-trading of top wallets

- Chain-specific DEX integration (e.g. Pump.fun, GasPump)

Web Platforms Offer:

- Clean dashboards for long-term tracking

- DCA bots and grid strategies

- CEX integration (3Commas, Cryptohopper)

- Strategy automation for larger positions

Don’t be seduced by graphs. Use what makes money — not what looks pretty.

✅ Pros and Cons Summary (No Fluff)

Telegram Bots

✅ Fastest trade execution

✅ Best for memecoins, DEX sniping, and copy-trades

✅ Mobile-first, minimal setup

✅ MEV protection and anti-rug features

❌ No built-in charts

❌ Scam bots exist

❌ You need to know what you’re doing

Web Interfaces

✅ Excellent for swing trades

✅ Best for BTC/ETH strategies

✅ Visual dashboards and strategy tools

✅ Safer for new users (if used correctly)

❌ Slow for token launches

❌ Poor mobile UX for sniping

❌ Not useful for new token discovery

🌐 USEFUL SOURCES TO BUILD TRUST (AND STAY AHEAD)

Want to dive deeper or verify smart contract tools, bot communities, and crypto trading strategies?

These are trusted sources I actually use:

- Telegram.org — Official app behind every Telegram trading bot

- OpenAI — AI models helping power crypto trade automation and prediction

- GitHub — Where top bots publish their open-source code and updates

- Reddit: r/CryptoCurrency — Real user experiences, token news, and alpha from the crowd

- Etherscan.io — Token contracts, rug detection, gas tracking, and wallet history

- DeFiLlama — Cross-chain data to check liquidity, TVL, and chain trends

🙋 FAQ: What Traders Ask Most

Are Telegram bots safe to use for crypto trading?

Yes — as long as you use well-known bots and basic security practices. Telegram bots never need your seed phrase. The safest setup is to use a burner wallet per chain, never leave large amounts idle, and revoke approvals regularly. Bots like TonTradingBot, Trojan, and Maestro also include anti-rug and MEV protection. Most hacks come from user error — not the bots themselves.

Which Telegram bot works on the most blockchains?

Maestro is the most versatile in 2025. It supports Ethereum, BSC, Base, Avalanche, Arbitrum, Metis, and now TRX. That means one bot can cover all your DEX sniping needs across most major chains. It’s ideal if you want to keep your tools simple while still staying active in multiple ecosystems. Just connect different wallets per chain and you’re good to go.

Can I trade entirely from my phone using Telegram bots?

Absolutely — that’s the whole point. Telegram bots are mobile-native. No browser, no apps, no extensions. You can snipe, sell, copy wallets, set stop-losses, and even launch your own token — all from chat. Bots like TonTradingBot and SuiSniperBot are specifically optimized for one-tap mobile trading. For launch traders and memecoin hunters, using your phone is faster and more natural.

Are Telegram bots legal to use for trading?

Yes, Telegram bots are simply interfaces that interact with public blockchain smart contracts. There’s nothing illegal about using them. That said, always be aware of local regulations and tax laws in your country. These bots are tools — what matters is how you use them. Copy-trading, sniping, and token launching are all legal behaviors in DeFi ecosystems like Solana, SUI, TON, and Ethereum.

What’s the best bot to trade tokens on Hyperliquid (HYPE)?

The only serious option right now is HyperEVM Sniper Bot. It supports HPump.trade, LiquidLaunch, multi-wallet setups, and bridging between Hyper’s L1 and EVM chains. It also includes copy-trading, auto-sell, and stop-loss features. I tested it in May 2025 and successfully sniped three tokens with under 10 seconds total setup. If you’re serious about Hyper, this is the only tool you need.

Do web trading bots like 3Commas work for memecoin sniping?

No. Web bots like 3Commas are designed for swing trades, DCA strategies, and long-term logic. They’re great for structured trades on BTC, ETH, and major altcoins — not for racing bots to a brand-new liquidity pool. Their APIs don’t react fast enough to sudden liquidity or token launches. Use them for portfolio scaling, not for memecoin snipes.

What features actually help avoid rug pulls?

Look for bots with MEV protection, anti-rug scanning, and slippage alerts. For example, Trojan On Sol has a panic-sell button and alerts if trading is paused. Maestro includes rug-score warnings. These tools can’t guarantee safety — but they dramatically reduce the risk by flagging bad contracts early. You still need to do your own research, but these features help a lot under pressure.

Can I copy-trade wallets using Telegram bots?

Yes, and it works surprisingly well when done right. Most sniper bots now let you monitor wallets and automatically copy trades. You can even filter by token type, chain, or volume. I’ve used this with XRP Sniper and Maestro to follow whale wallets — catching solid early entries on multiple tokens. Just don’t blindly copy everything. Watch the wallet’s success rate over time.

Why not just use a DEX or browser wallet to trade?

For memecoins or launch trading, DEX + browser = slow. You have to open tabs, connect wallets, confirm swaps, and deal with lag. Telegram bots skip all that. One tap. No waiting. No approvals each time. You still use the same wallet under the hood — it’s just a much faster interface layered on top of it. If you’re aiming for Block 0, chat is faster.

What’s the future of crypto trading : bots or dashboards?

It’s both. Bots win on execution speed, especially for DeFi, memecoins, and low-cap launches. Dashboards win on data and strategy for blue-chip tokens. Most pro traders in 2025 combine both: they use Telegram bots for fast entries and exits, then web dashboards like Unibot or 3Commas for long-term management. It’s no longer a question of either/or it’s a toolkit.

My Final Words: Choose Based on How You Trade

If you’re launching into fresh liquidity, racing bots to block 0, and flipping tokens within minutes — Telegram bots are your oxygen mask.

If you’re trading top 20 coins with 3-day windows and risk-managed grids — web interfaces will give you the structure you want.

I personally snipe with Telegram bots. I manage my DCA strategies with 3Commas. The combo works — and lets me profit in both fast and slow markets.

📌 You don’t need all bots.

But you need the right one for your chain, your timing, and your style.

About the author

Learn more about us or contact us

Leave a Reply