Choosing the right Solana trading bot can be hard, and if you’ve been searching Reddit for a real GMGN vs Photon vs Axiom review, you’ve probably seen mixed opinions.

Each bot has its own style, speed, and pricing, and traders swear by different features. In this guide, we break down exactly how GMGN, Photon, and Axiom compare, from fees and speed to special features. so you can find out which bot matches your strategy.

Table of Contents

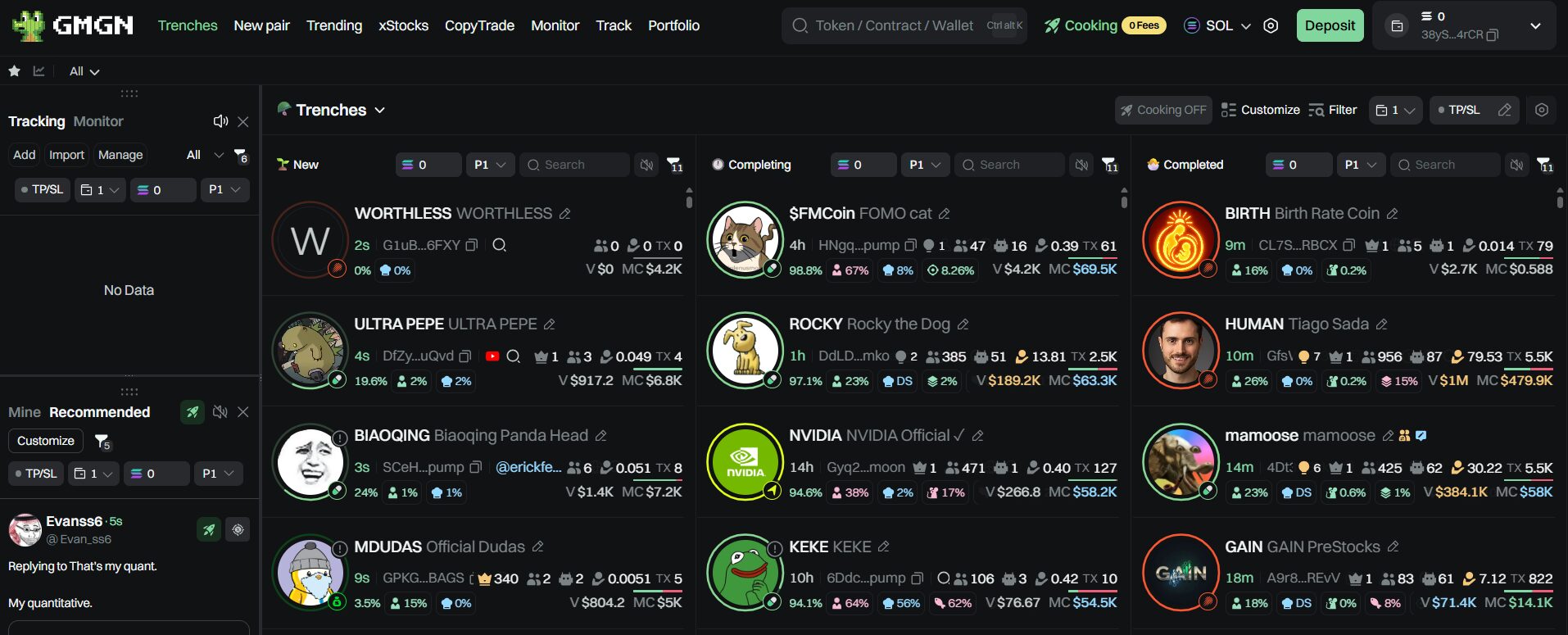

GMGN: Best for Automation and Copy Trading

What it is

GMGN runs on Telegram and the web app, so it works on any device. It’s built for traders who want to set rules once and let the bot do the work with alerts, automation, and tracking.

Features

- 🔥Automation tools: Quick Buy with TP/SL, trailing, auto buy/sell, limits

- 👀Copy trading: mirror profitable wallets

- ⚡Wallet alerts: zero-latency notifications

- 📊Market discovery: Trenches, New Pair, Trending, xStocks

- 🔑Multi-wallet: import/export/manage

- 📢Signals integration: CopySignal for Pump.fun

- 🔍Portfolio tracking: holdings, PnL, history

Speed

Fast for most launches. Execution depends on your priority fee. In heavy congestion, Photon or Axiom may pull ahead.

Fees

- 💱1% per trade

- ⛽Plus Solana gas and optional priority fee

- 🚀Higher priority fee can increase execution speed

How to use GMGN

- 🔗Open GMGN quick access and choose Telegram or Web

- 🔐Connect or create a wallet and back up the key

- ⚙️Set Quick Buy or SnipeX rules (slippage, TP, SL, trailing)

- 📈Turn on wallet alerts and follow your watchlist

- ⏫Adjust priority fee for speed when the network is busy

- 🧭Review PnL in Portfolio and refine settings

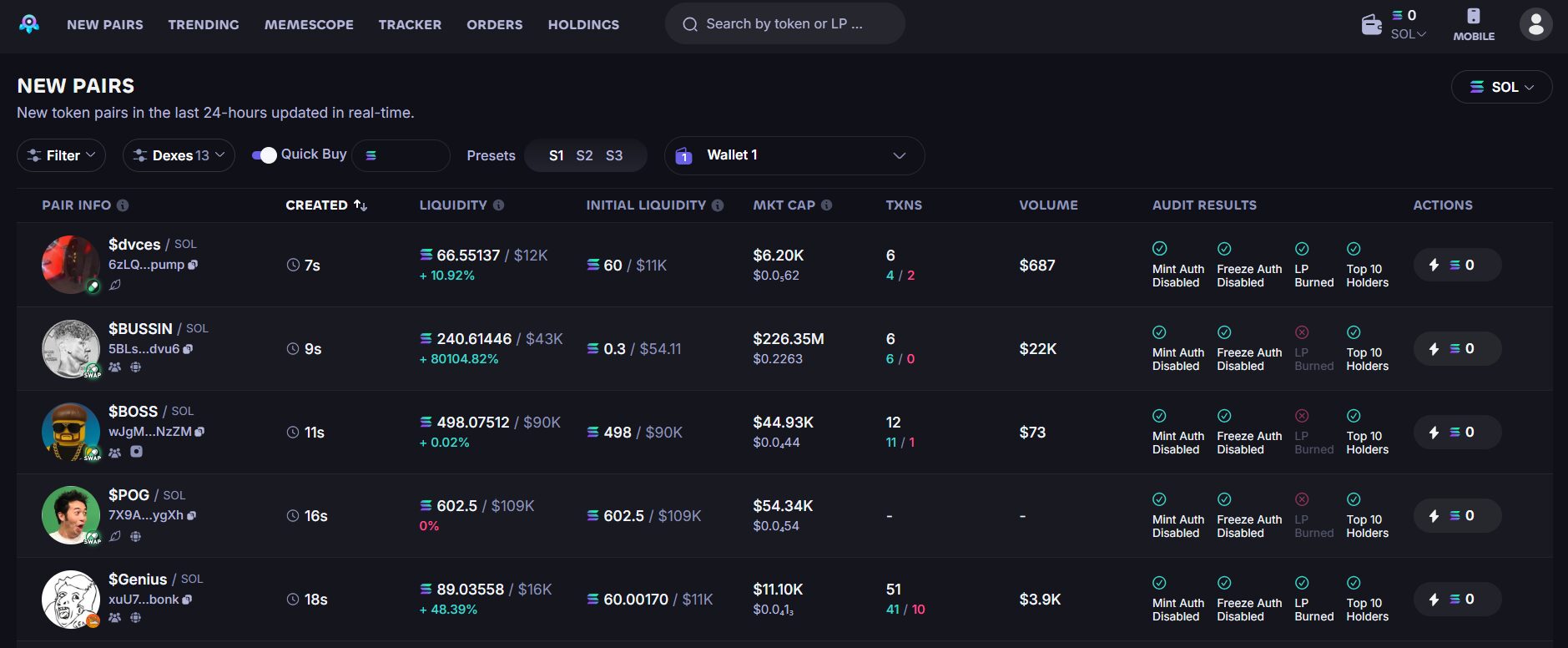

Photon: Best for Speed and Manual Precision

What it is

Photon is a web-based trading bot built for speed and control. No Telegram delays: just direct, fast execution with full chart access and pro tools.

Features

- 🚀 Smart-MEV protection: stops frontrunning and sandwich attacks

- 📡 Live Pairs feed: see new listings instantly

- 📈 Memescope: find trending meme tokens fast

- 🛠 Advanced filters: liquidity, volume, price, RSI, moving averages

- 📱 Full mobile trading: buy/sell anywhere from your phone

- 📂 Multi-wallet: manage multiple accounts without logging out

- 🔄 DCA & limit orders: automate entries/exits without leaving the chart

Speed

Sub-second execution. Perfect for traders who react manually but still want the fastest path from decision to trade.

Fees

- 💱 1% per trade: charged on each buy and sell

- ⛽ Plus gas and optional bribes for faster confirmations

How to use Photon

- 🔗 Open Photon’s official web app

- 🔐 Connect Phantom or Solflare wallet

- 🛠 Use filters to find your target tokens

- 💵 Click the token, set amount and slippage

- ⚡ Execute and track your position in real time

- 💾 Save filter presets to repeat your setup instantly

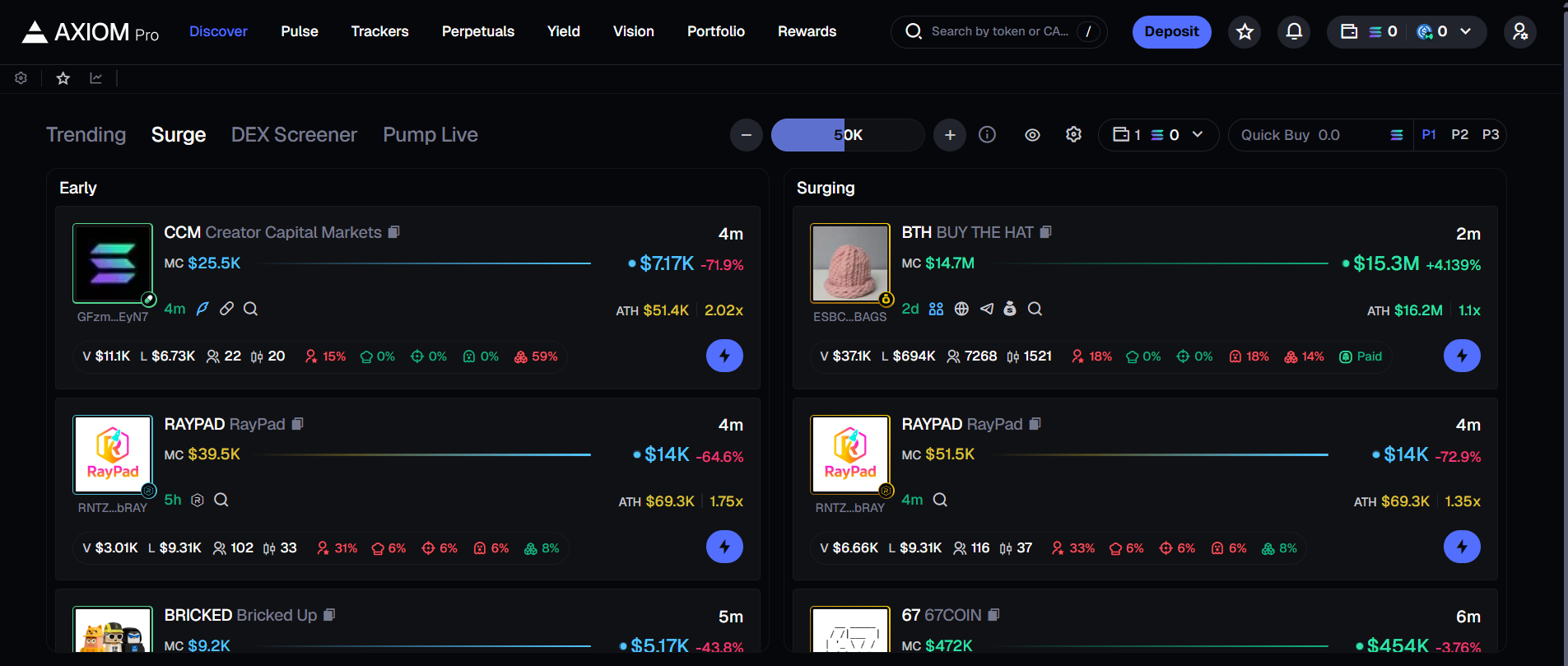

Axiom: Best for Pro Traders and Low Fees

What it is

Axiom feels like a professional trading terminal for Solana. It’s built for traders who want advanced analytics, perpetuals, and a cashback fee system.

Features

- 💹 Token aggregation: Combines Pump.fun, Raydium, and Moonshot listings

- 🔍 Trader scan: Tracks wallet movements, bundlers, and snipers

- 📊 Advanced charting: Technical indicators, order books, and top holders

- 💼 Multi-wallet: Sign up by email or connect existing wallets

- 📉 Perpetuals: Trade with up to 50× leverage via Hyperliquid

- 🎁 Cashback tiers: Up to 0.25% back in SOL for high volume

- 🔔 Custom alerts: Price triggers, wallet activity, and token events

Speed

Matches Photon in execution and offers 99.9% uptime, excellent for volatile conditions.

Fees

- 💱 0.75–0.95% per trade depending on tier

- 🎁 Cashback for frequent traders

- ⛽ Gas + optional bribes

How to use Axiom

- 🔗 Visit Axiom’s platform

- 💼 Sign up by email or connect wallet

- 📋 Set watchlists and custom alerts

- 💹 Choose your token and adjust slippage/fees

- 📉 Trade spot or perpetuals directly

- 🎯 Increase volume to unlock higher cashback tiers

GMGN vs Photon vs Axiom Comparison

GMGN GMGN |  Photon Photon |  Axiom Axiom | |

|---|---|---|---|

| Automation | ✅ | ❌ | ✅ |

| Copy Trading | ✅ | ❌ | ❌ |

| MEV Protection | Basic | Advanced | Advanced |

| Advanced Filters | Moderate | ✅ | ✅ |

| Multi-Chain Support | ✅ | ✅ | Limited |

| Perpetuals | ❌ | ❌ | ✅ |

| Charting Tools | Basic | Basic | Advanced |

| Alerts / Notifications | ✅ | ✅ | ✅ |

| Signal Integration | ✅ | ❌ | ❌ |

| Mobile Trading | Telegram | Full mobile | Full mobile |

| Speed | Fast | Very Fast | Very Fast |

| Portfolio Tracking | ✅ | ✅ | ✅ |

| Order Types | Full suite | Limit / DCA | Full suite |

| Fee per Trade | 1% | 1% | 0.75–0.95% |

| Cashback | ❌ | ❌ | ✅ |

| Best For | Automation & copy trading | Manual high-speed sniping | Pro traders & high volume |

| Notes | Costs rise with high priority fee | Simple fee; can be pricey for heavy trading | Cashback lowers net fee as volume grows |

| Launch GMGN | Launch Photon | Launch Axiom |

More Features

- ⚙️Moderate filters

- 💳1% fee

- 📈Basic charts

More Features

- 📈Basic charts

- 💳1% fee

- ⚠️Pricy for heavy use

More Features

- ⚙️Full order suite

- 💳0.75–0.95% fee

- 📈Portfolio tracking

GMGN shines for automation and copy-trading. Photon wins on pure speed for manual traders. Axiom offers pro tools, perpetuals, and fee cashback.

Strategies with Solana Trading Bots

GMGN Strategies

- 🪞 Smart Wallet Mirroring: CopyTrade profitable wallets and pair with auto-sell at a set PnL multiplier.

Pro tip: Review 30–60 days of wallet history (win rate, average hold time) before mirroring. - 🎯 Event Sniping: Use “First 70 Buyers” + Quick Buy; add trailing stop to protect gains on spikes.

Pro tip: Best on low-liquidity, high-vol tokens; reduce size after 2–3 consecutive wins to avoid overconfidence. - 🔀 Multi-Chain Rotation: Switch between Solana/Base with multi-wallet presets to catch fresh listings round the clock.

Pro tip: Keep chain-specific slippage/priority fees saved; never reuse one chain’s slippage on another.

- 🧯 Risk Controls: size ≤ 0.5–1.5% per entry; TP ladder at +15% / +30% / +50%; trailing stop 8–12% after +20% move.

- ⚙️ Quick Preset: Slippage 0.5–1.2% (SOL) • Priority fee: moderate • Auto-sell: 1.3–1.6× • Max hold: 45–90 min.

Photon Strategies

- 💧 Liquidity Spike Hunting: Filter for thin liquidity + sudden volume; enter fast, take base hits.

Pro tip: Keep slippage tight (0.3–0.8%) unless volume surges 3–5× in minutes. - ⚡ Trending Scalps: Use Memescope for tokens < $50k liquidity; quick in/out, no diamond hands.

Pro tip: Skip charts with concentrated dev or CEX wallet exposure. - 📐 Technical Trigger Snipes: Trade only when RSI and MA crossover align; ignore single-signal noise.

Pro tip: Save two presets: “Tight” (low slippage) and “Rush” (higher slippage) to switch instantly.

- 🧯 Risk Controls: single-trade cap 0.5–1% • Hard stop 6–10% • First take-profit at +8–12%, then trail.

- ⚙️ Quick Preset: Slippage 0.3–0.8% • “Very Fast” path on spikes • Limit/DCA for planned entries • Auto-reduce size after 2 losses.

Axiom Strategies

- 🎁 Cashback Tier Farming: Stack frequent small trades to climb tiers, then scale size once net fee drops.

Pro tip: Use Trader Scan to track active wallets and recycle repeatable patterns. - 📉 Perpetual Swing Trades: Trade trending coins via Hyperliquid with conservative leverage (≤3–5×).

Pro tip: Pre-define invalidation; if price closes past invalidation, exit: no exceptions. - 📰 News-Driven Entries: Use aggregation alerts; buy after confirmed positive updates with liquidity locks checked.

Pro tip: Avoid tokens with unlocked large treasuries before catalysts.

- 🧯 Risk Controls: perps margin per trade ≤ 0.5–1% of equity • Max concurrent perps: 2 • Daily loss stop: 3R.

- ⚙️ Quick Preset: Spot fee 0.75–0.95% (tiered) with cashback • Slippage 0.3–1.0% • Alerts: price + wallet activity + liquidity lock.

Cross-Bot Checklist (use before every trade)

- 🔐Contract safety: verified, mint revoked (if relevant), LP locked or owned by burn.

- 💧Liquidity sanity: depth supports your size (impact < 1–2%).

- 📊Volume path: sustainable flows (not single whale prints).

- 🧠Plan: entry, invalidation, partials, exit: written before click.

- ⏱️Hold time: pre-decide max hold; if thesis breaks, cut quickly.

How to Validate a Strategy in 60 Trades

- 🧪Run 20-trade pilot at micro size. Log entry reason, slippage, exit type.

- 📈Evaluate: win rate, avg win/avg loss, profit factor, time-in-trade.

- 🔁Tweak one variable (slippage, trailing) and run another 20 trades.

- ✅Scale only if profit factor ≥ 1.3 and max drawdown < 10% across 60 trades.

FAQ

Which is faster for sniping new tokens, GMGN, Photon, or Axiom?

Photon is often slightly faster in high-congestion launches, while GMGN is reliable if you tweak priority fees. Axiom can also match Photon’s speed, especially for active traders on its highest tiers.

Do GMGN, Photon, and Axiom work on both Telegram and web browsers?

GMGN and Photon now run on both Telegram and their web apps. Axiom is fully web-based but also offers wallet tracking and trading alerts via Telegram.

What are the trading fees for GMGN, Photon, and Axiom?

GMGN and Photon both charge around 1% per trade plus network gas. Axiom’s fees start at 0.95% but drop with higher trading volume, offering cashback rewards.

Can I use multiple wallets on GMGN, Photon, or Axiom?

Yes, all three support multi-wallet management. This allows you to track, trade, and separate funds easily.

Which bot has the best protection against MEV attacks?

Photon offers built-in Smart-MEV protection. GMGN and Axiom do not market MEV protection as a main feature.

How do I set up automated trading on GMGN, Photon, or Axiom?

On GMGN, enable auto-buy/sell and set your stop-loss or trailing stop. On Photon and Axiom, you can also create limit orders, DCA setups, and follow specific wallets.

Are these bots beginner-friendly or only for advanced traders?

GMGN is simple enough for beginners, especially via Telegram. Photon and Axiom have more advanced options, but their interfaces are still easy to navigate.

Which bot is best for tracking wallet activity in real time?

GMGN’s zero-latency wallet alerts are very fast. Photon and Axiom also offer wallet tracking but with slightly different alert speeds and formats.

Resources

About the author

Learn more about us or contact us