What’s Actually Different Between MetaMask and Telegram Bots?

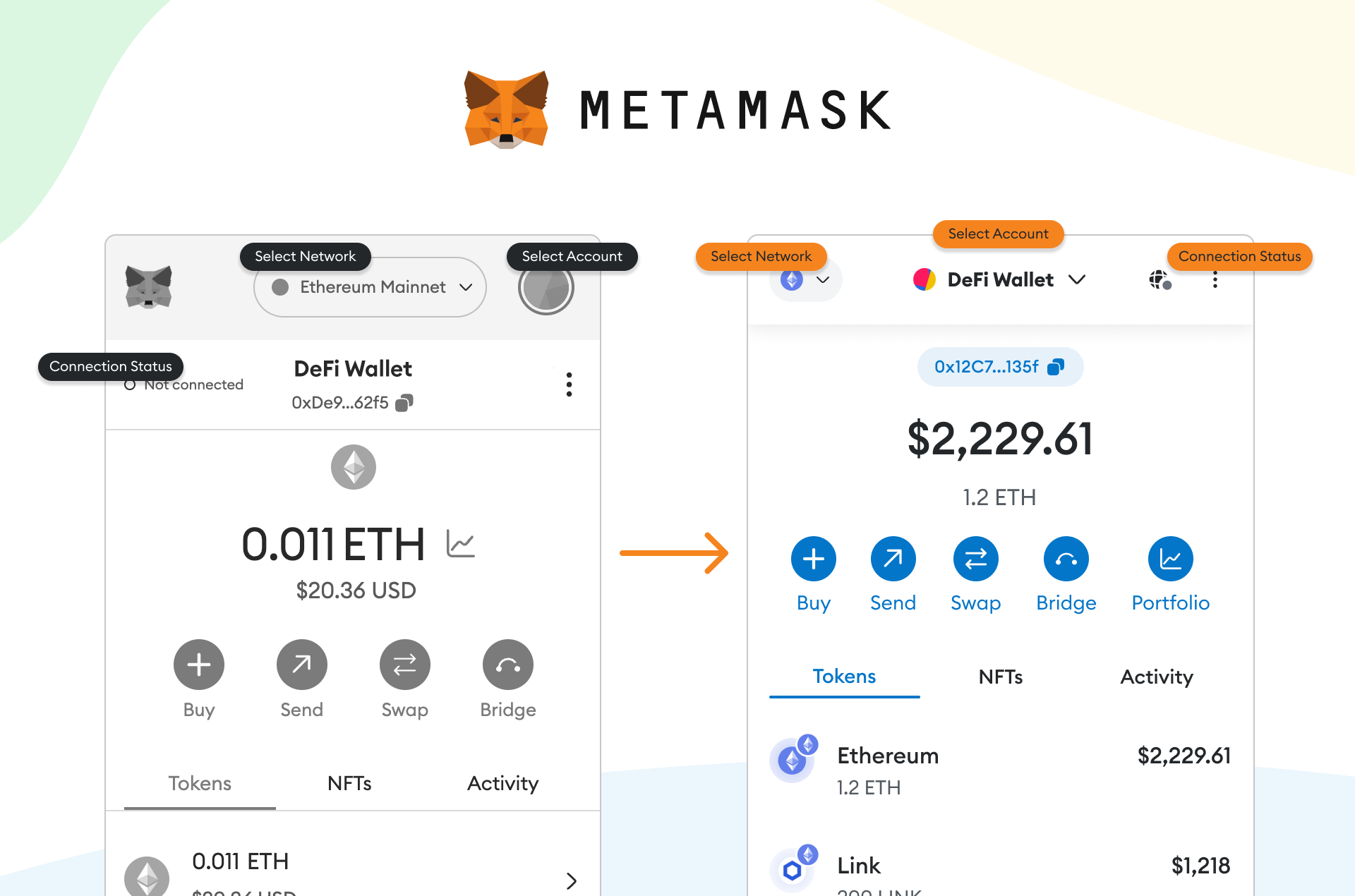

MetaMask and Telegram trading bots weren’t built to solve the same problem. MetaMask started as a self-custodial gateway to Web3, built for ownership, security, and connecting to basically every DeFi protocol out there. You hold your private keys, approve every transaction manually, and can interact with thousands of dapps across multiple chains.

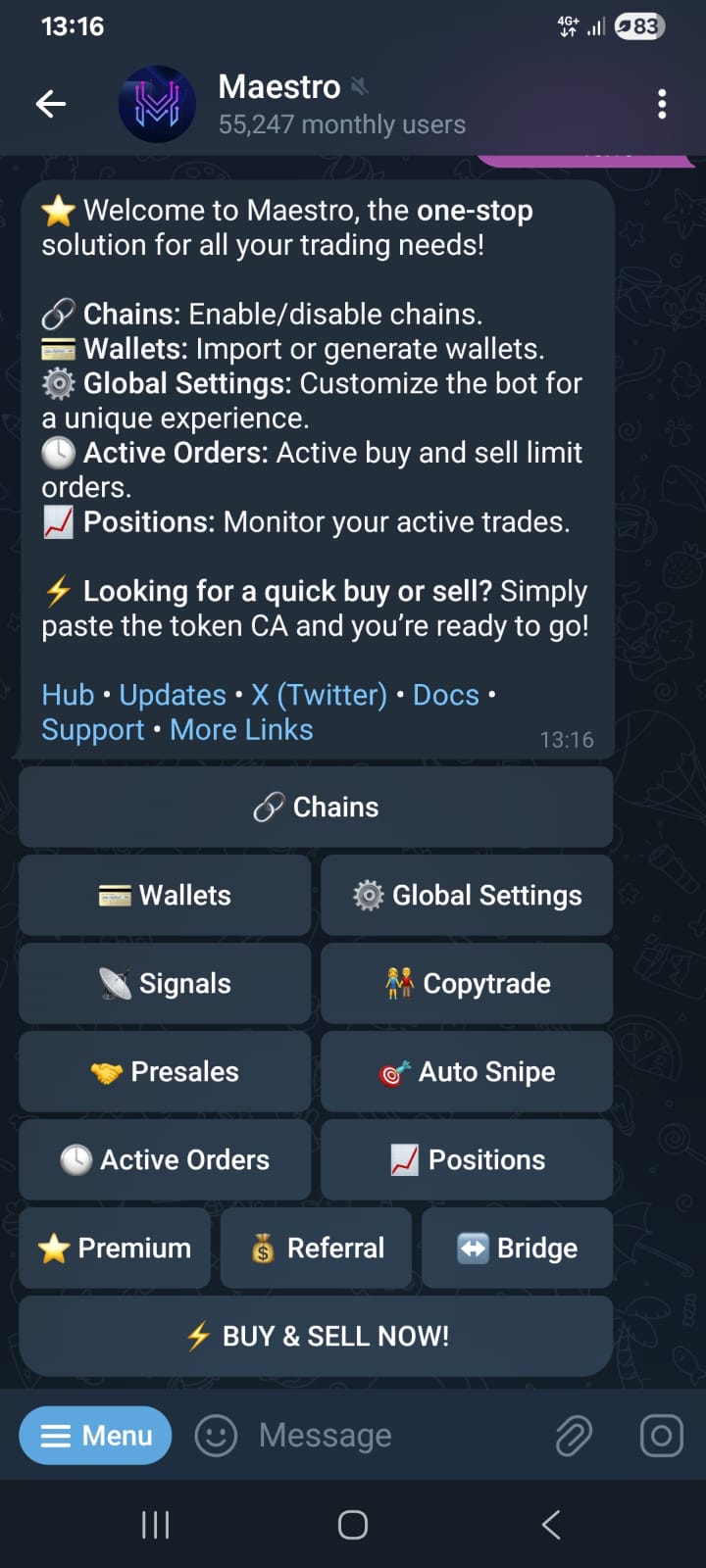

Telegram bots exist for one thing: executing trades fast as hell. They take everything (wallet management, price tracking, execution) and compress it into a system where you can go from seeing an opportunity to being in the trade in under a second.

⚡ Speed: Bots execute trades in milliseconds while MetaMask requires manual confirmations

🔐 Security: MetaMask provides explicit approval for every interaction

📱 Convenience: Telegram environments eliminate friction on mobile devices

🎯 Specialization: Bots excel at sniping, copy trading, and rapid rotations

🌐 Compatibility: MetaMask connects to the entire DeFi ecosystem

Why Do People Still Use MetaMask?

MetaMask is basically the standard wallet for anyone doing actual DeFi. It works with Ethereum mainnet and all the major L2s (Arbitrum, Optimism, Polygon, Base, Avalanche, you name it). If you know what you’re doing, you can add custom RPC endpoints to connect to new chains the day they launch. Plus you can hook up a hardware wallet like Ledger for extra security on bigger bags.

When MetaMask Is Your Best Choice

- Exploring diverse DeFi protocols across multiple chains

- Staking, yield farming, or providing liquidity

- Minting or trading NFTs on major marketplaces

- Storing significant capital with maximum custody control

- Using hardware wallets for enhanced security

- Interacting with governance systems and DAOs

Think of MetaMask as your main bank account for crypto. Reliable, works everywhere, and gives you full control. The tradeoff is it’s not built for speed trading.

What Makes Telegram Trading Bots Different?

Here’s the thing: when a token launches or a narrative pumps, you have maybe 5-10 seconds before you’re buying way higher than the early birds. Traditional wallets can’t keep up. Telegram bots were built specifically to fix this problem by automating everything from finding the contract to executing with optimal gas.

Core Advantages of Trading Bots

- Sniper functions capture tokens the instant liquidity appears

- Copy trading mirrors profitable wallets automatically

- Whale tracking sends instant notifications on large transactions

- Pre-configured gas optimization and MEV protection

- Multi-wallet management from a single interface

- Automated take-profit and stop-loss execution

During launches or sudden pumps, those milliseconds matter more than you’d think. By the time someone opens MetaMask, reviews the transaction, and hits confirm, bot users are already in and sometimes taking profit.

Start Trading with Maestro BotHow Do Experienced Traders Use Both Tools?

Most profitable traders don’t pick one or the other. They use both, but for totally different purposes. Here’s the setup that actually works:

Treasury Management: Your main stack stays in MetaMask or cold storage. Hardware wallet if you’re holding real money. This is your vault, and you only move funds out when you have a plan.

Active Trading Capital: You keep smaller amounts in Telegram bots for quick plays. This is your trading ammo for launches, sniping, and fast rotations that need instant execution.

Profit Extraction: When you make good trades through the bot, you sweep profits back to the vault regularly. This way you’re never overexposed in hot wallets but you can still catch opportunities.

This setup means you’re not gambling your whole portfolio on fast trades, but you’re also not sitting on the sidelines while everyone else is eating. It’s just smart risk management.

Feature-by-Feature Comparison

| Feature | MetaMask | Telegram Bots |

|---|---|---|

| Custody Model | Full user ownership | Varies by setup |

| Token Sniping | Manual, complex setup | Built-in, one-tap |

| Copy Trading | Not available | Automated following |

| Execution Speed | 10-30 seconds | Under 1 second |

| DeFi Protocol Access | Universal support | Limited to swaps |

| Hardware Wallet Support | Yes | No |

| Multi-Chain Support | Extensive | Major chains only |

| Mobile Experience | Good | Excellent |

When Should You Actually Use a Trading Bot?

Look, bots aren’t for everything. But there are specific situations where trying to trade manually is basically throwing money away:

🔥 Token Launches: Fair launches and stealth drops where milliseconds determine if you enter at $50K market cap or $500K

📈 Narrative Rotations: When attention shifts fast between sectors and you need to rotate positions in seconds, not minutes

👥 Wallet Mirroring: Following proven traders only works if you can copy their moves instantly

⚡ Volatility Spikes: During extreme price action, hesitation costs real money and bots remove that emotional friction

🎯 Memecoin Trading: The memecoin meta moves way too fast for manual wallet workflows

Which One Is Actually Safer?

MetaMask wins on pure custody security because nothing happens without you clicking approve. But that doesn’t mean it’s foolproof. Plenty of people still get drained by signing malicious token approvals without checking what they’re actually authorizing.

With Telegram bots, you’re trusting the platform more. Good news is most reputable bots (like Maestro) are non-custodial, meaning you still control your seed phrase. The risk is more about operational security: keeping your bot access secure and not getting phished.

Real talk: most people lose money the same way on both platforms. Phishing scams, signing sketchy contracts, and FOMO decisions during pumps. Your choice of wallet doesn’t fix bad habits.

So Which One Should You Use?

Depends what you’re doing. If you’re holding long-term or doing actual DeFi stuff (staking, LPing, yield farming), stick with MetaMask and use a hardware wallet for anything serious. You want that extra security layer when you’re not actively trading.

If you’re trading short-term plays, especially in fast-moving metas like memecoins or new launches, you need a bot. MetaMask just can’t compete on speed.

Honestly? Most people who make real money use both. MetaMask for storage and serious DeFi. Bots for trading and quick opportunities. That’s the actual meta.

Read Full Maestro Bot ReviewFrequently Asked Questions

Official Resources & Documentation

For the most accurate and up-to-date information, always refer to official sources:

📚 MetaMask Official Documentation: support.metamask.io – Comprehensive guides on wallet setup, security best practices, and troubleshooting

🌐 MetaMask Website: metamask.io – Download the official extension and mobile apps

🤖 Maestro Bot Official: t.me/MaestroSniperBot – Access the official Maestro trading bot on Telegram

📖 Maestro Documentation: docs.maestrobots.com – Complete guide to features, commands, and advanced strategies

Always verify you’re using official links and never share your seed phrase with anyone. Both MetaMask and Maestro teams will never ask for your private keys.