Table of Contents

What is Bloom sniper bot and why is it gaining attention in 2026?

Bloom is a Telegram trading bot that has risen fast recently. Built with speed and simplicity in mind, it offers two dedicated bots, and in this Bloom Bot Review we’ll look at why traders are choosing it over older tools:

🟪 Bloom Solana Bot: optimized for Solana DEXs like Raydium, Pump.fun, Orca, and Meteora.

🟦 Bloom EVM Bot: designed for Ethereum, BSC, Base, Monad, HyperEVM and more with Bloom EVM 2.0 on the way.

Unlike older bots, Bloom was rebuilt from scratch with a v2.0 architecture that delivers sub-millisecond blockchain event detection. That makes it one of the fastest Telegram bots available, even under high network congestion.

Bloom markets itself as “your unfair advantage in crypto” and given its rapid adoption and technical upgrades, many traders agree.

Bloom also offer a web extension for Chrome now, and it is lighting fast !

How does Bloom trading bot actually function inside Telegram?

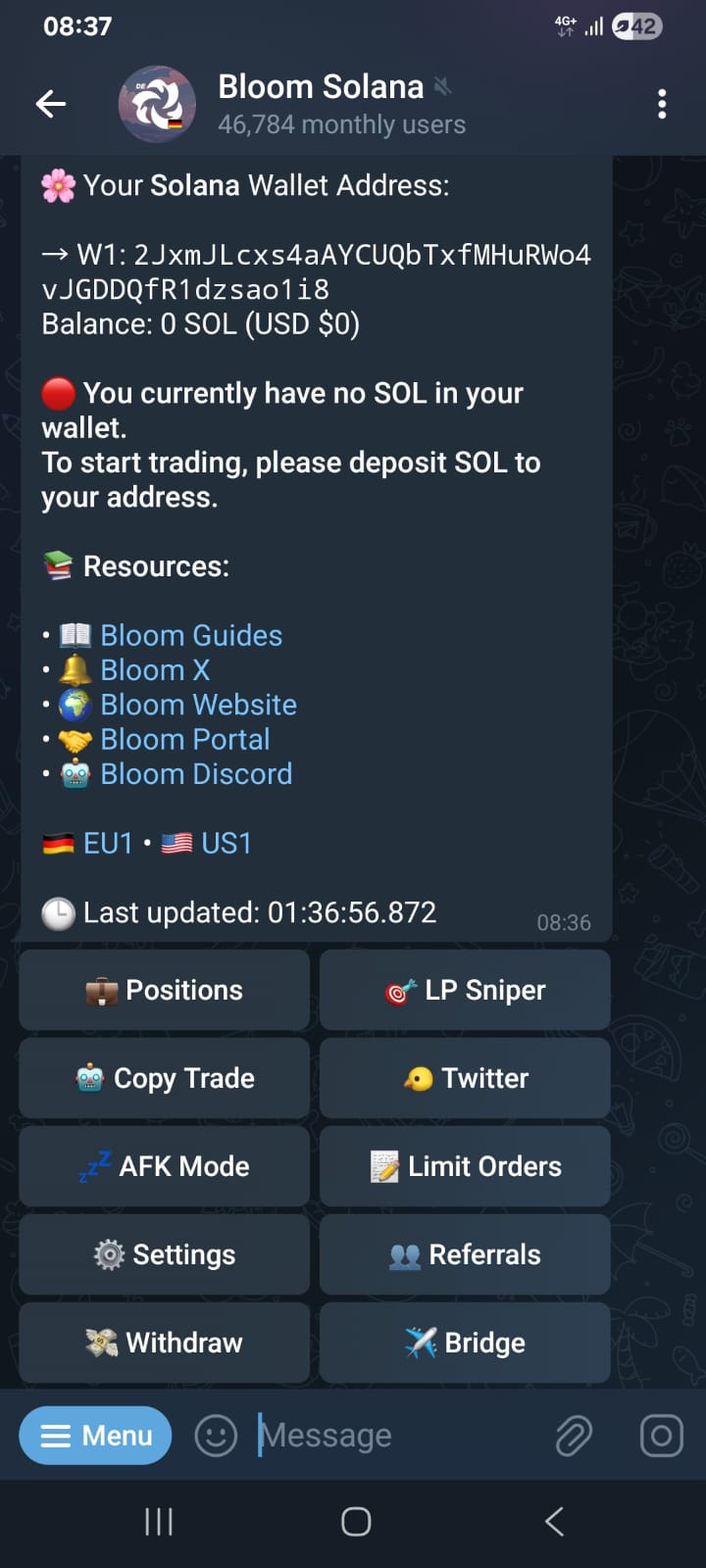

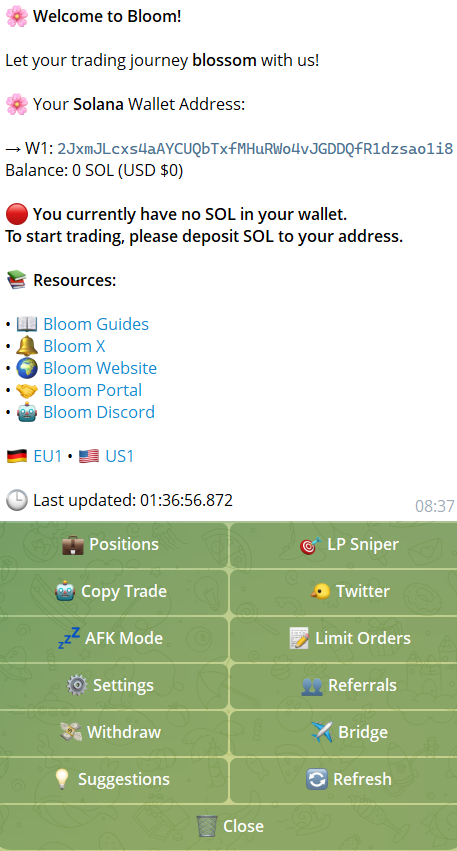

Bloom works like a private crypto cockpit inside Telegram. Instead of typing commands, users get big, colorful buttons for every action.

For beginners, the workflow is straightforward:

- Start the bot → verify with captcha → open dashboard

- Create or import a non-custodial wallet

- Choose your chain (Solana or EVM) and fund with gas

- Tap options like Sniper, Copy Trade, or AFK Mode to start trading

- Withdraw profits any time with one button

From day one, Bloom was designed for tap-to-trade simplicity. Even complex features like Twitter OCR sniping or AFK copy trading are hidden behind easy menu choices.

Which tools and features make Bloom trading bot different?

Bloom packs a mix of sniping, automation, and protection tools that appeal to both beginners and advanced degen traders.

| Feature | Description |

|---|---|

| ⚡ Sub-Millisecond Detection | Bloom v2.0 infrastructure detects blockchain events instantly for faster fills |

| 🎯 Multi-Limit Orders | Place multiple buy and sell levels to execute your strategy with precision |

| 😴 AFK Mode + Social Sniping | Automate buys from Twitter posts, replies, reposts, and even OCR images |

| 📊 Copy-Trading | Mirror top wallets in real time with customizable position sizing |

| 🛡️ MEV Protection & Filters | Protect against sandwich attacks and block suspicious contract activity |

| 🌉 In-Bot Bridge | Move assets across chains without leaving the Telegram bot |

| 🧩 Chrome Extension | Desktop add-on with faster execution, wallet integration, and extra tools |

| 💸 Cashback & Referrals | Earn fee rebates and discounts as your trading volume and referrals increase |

| 🗺️ Dual-Bot Architecture | Dedicated Bloom Solana Bot and Bloom EVM Bot for ETH, BSC, Base, and HyperEVM |

| 📈 Portfolio, Alerts & Leaderboard | Track positions, get whale/price alerts, and compare performance with others |

How quick is Bloom Telegram bot compared to other Telegram bots?

Speed is where Bloom shines. With its v2.0 rebuild, Bloom achieved sub-millisecond blockchain event detection on Solana. In practical terms, this means:

- ~0.15s average snipe on Solana

- ~0.20–0.25s average on EVM chains (with Bloom EVM 2.0 set to lower this further)

Community benchmarks place Bloom among the fastest, consistently competitive with Maestro and Trojan. Unlike some rivals, Bloom’s design keeps speed stable under heavy traffic, not just in test conditions.

| Bot | Average Buy Speed | Verdict |

|---|---|---|

| Bloom (Solana) | 0.15 s SOL | Fastest on Solana |

| Bloom (EVM) | 0.20–0.25 s EVM | Top multi-chain choice |

| Maestro | 0.25 s EVM • 0.15 s SOL | Proven but older infra |

| Trojan | 0.18 s SOL | Best Solana-only |

| Sigma | 0.30 s EVM | Solid backup |

What blockchains and DEX integrations does Bloom sniper bot cover today?

Bloom sniper bot supports a wide set of networks and leading decentralized exchanges (DEX).

Supported Chains & Key DEXs

- Solana → Raydium, Pump.fun, Orca, Meteora, Moonshot, LaunchLab, DAOS.fun

🆕 Added Pump.fun Mayhem to the platforms filter on Copy, Twitter and AFK - Ethereum → Uniswap V2/V3

- BSC → PancakeSwap V2/V3 – FLAP

- Base → Aerodrome, key pools

- HyperEVM → fast, low-fee EVM expansion

- USDT support on FourMeme, Copy, AFK and Twitter

This dual-bot setup (Solana + EVM) makes Bloom versatile for both meme snipers on Solana and DeFi traders on Ethereum/BSC.

What is the trading experience like on Bloom trading bot for mobile users?

Bloom’s UI inside Telegram is button-driven and designed for mobile traders. The menu includes:

📌 Positions

🟦 Copy Trade

😴 AFK Mode

🐦 Twitter Sniping

📌 Orders

🌉 Bridge

Instead of cryptic commands, you simply tap what you need. Gas sliders, slippage settings, and charts are built in. Bloom also offers a Chrome Extension for those who prefer desktop terminals, combining the Telegram bot with richer analytics.

How secure is Bloom sniper bot for crypto trading?

Bloom is non-custodial, meaning your keys never leave Telegram’s encrypted storage.

🔐 AES-encrypted wallets – private keys protected inside the bot

🛡️ MEV Protection – shields against sandwich/front-running attacks

🚫 Rug Filters – scans contracts for high tax and suspicious code

🤝 Community Reporting – users flag scam contracts, updated quickly

As with all DeFi bots, risk never disappears. But Bloom has implemented protection layers that reduce common threats, making it safer than most Telegram clones.

What fees does Bloom Telegram Bot charge and are there discounts?

Bloom keeps pricing transparent.

- Flat trading fee: ~1% per buy or sell

- No subscription fees

- No withdrawal fees (only network gas)

- Cashback + referral discounts: active users earn partial rebates

For high-volume traders, the cashback system can noticeably reduce costs.

How do you set up Bloom Sniper Bot on Solana and EVM step by step?

How to use Bloom Telegram Trading Bot?

Open Bloom for Solana or Bloom EVM for ETH, Base, BSC, Hyperliquid on Telegram and tap Start

A wallet will be generated for you but you can also import your own wallet.

Send a bit of ETH, SOL, or other to that wallet

Set your slippage, priority fee, and MEV protection

Paste the contract and snipe/trade any token

Toggle Stop‑Loss or Rug Guard for safety

Cash out profits whenever you want

What strategies are traders using successfully with Bloom?

Bloom isn’t just about raw speed, the traders who perform best usually mix that speed with filters, automation, and discipline. Here are some of the approaches that stand out:

🐋 Copy the Whales

One of Bloom’s most-used features is Copy Trade. By linking your wallet to a proven “whale” address, you can mirror their buys and sells in real time. Instead of chasing hype blindly, this lets you ride the momentum of wallets that already have a track record of profitable snipes. Many traders reduce risk by setting a smaller stake size (e.g., 5–10% of their bankroll) so they scale in without overexposure.

🔒 Liquidity Lock Focus

Rug pulls are still a constant threat on new launches. Bloom’s filters allow you to focus only on pairs with liquidity locked for 30+ days or above 70%. This narrows the pool of tokens you snipe but dramatically raises the odds of catching projects where developers have committed capital. It’s a slower but safer way to hunt.

⛽ Gas Boost Trick

In competitive launches, being early by even a fraction of a second can decide whether you buy at launch price or 3x higher. Bloom lets you boost gas priority slightly above the network average (for example, 1.2x). This small adjustment often pushes your transaction into the first block without wasting funds on excessive gas wars.

🐦 AFK Twitter Mode

Bloom’s AFK Mode with Twitter OCR has become a favorite for degen traders. It scans tweets, replies, and reposts from selected accounts or hashtags, then executes buys automatically. Used carefully, this means you don’t have to sit glued to the screen — Bloom picks up early signals before they trend across the wider market. Pairing AFK Mode with tight stop-losses makes this less risky.

What extra utilities come with Bloom beyond sniping?

Bloom is more than a sniper, it’s built as a complete trading toolkit inside Telegram. Key extras include:

- 🌉 Cross-Chain Bridge – move tokens between networks without leaving the chat.

- 🐋 Wallet Tracking & Whale Alerts – follow key wallets and get instant pings on big moves.

- 🐦 AFK Social Sniping – auto-buy tokens from Twitter posts or Telegram alpha groups.

- 📊 Portfolio View – track balances, open trades, and PnL in real time.

- 🎁 Cashback & Referrals – reduce fees and earn rebates as you and your network trade.

- 🔥 Sell Only Copy Trading Buys: When enabled, the task sells only tokens bought via copy trading, skipping all others.

- 🆕 CopyTrading Reverse Mode enhanced, with a minimum sell threshold: Set the minimum percentage the target wallet must sell to trigger the task.

📌 These utilities make Bloom not just fast, but also practical for daily trading, reducing the need for external apps.

Try Bloom Sniper Bot now:

Solana | ETH | BASE | BSC | HYPEREVM

What are the main pros and cons of Bloom Telegram sniper bot?

No bot is perfect, and Bloom is no exception. Here’s what traders like most, and where it still has room to grow:

✅ Pros

- Blazing fast execution: Sub-millisecond detection on Solana and low-latency EVM support.

- Dual-bot system: Dedicated Solana bot plus an EVM bot covering ETH, BSC, Base, and HyperEVM.

- User-friendly: Big buttons, clean menus, and a guided setup make it easy even for beginners.

- Risk filters: Built-in Rug Protection, MEV shield, and liquidity lock filters reduce common traps.

- Cashback program: Unique fee rebates reward active trading.

- AFK + automation: Twitter OCR, social group scraping, and auto-trading tools run in the background.

❌ Cons

- Risk isn’t zero: Even with filters, sniping remains risky; a bad launch can still wipe profits.

- Telegram limits: Spammy actions (like mass copy-trading) can get slowed down by Telegram’s rate caps.

- No full desktop app: A Chrome extension exists, but some traders still want a standalone PC dashboard.

What does the trading community say about Bloom in their reviews?

Bloom’s community is growing quickly, and feedback has been positive overall.

A few reports mention Telegram rate limits during high-volume sniping, though this is common across all bots.

On Telegram groups, users highlight how Bloom consistently catches Pump.fun launches early, often ahead of rivals. On Reddit, traders praise the cashback system and referral rewards, saying it helps offset the 1% trade fee. Some note the EVM bot feels younger compared to Solana’s version, but confidence is high with Bloom EVM 2.0 around the corner.

Maestro Sniper Bot FAQ

Is Bloom Sniper Bot free to use?

Yes. There are no subscriptions, you only pay a ~1% trade fee on buys and sells.

Does Bloom trading bot have both Solana and EVM support?

Yes. Bloom offers two separate bots: one for Solana (Raydium, Pump.fun, Orca, etc.) and one for EVM chains (Ethereum, BSC, Base, HyperEVM).

Can Bloom Telegram bot snipe Pump.fun tokens?

Yes. Bloom Solana Bot integrates with Pump.fun and other Solana launchpads, making it a popular choice for meme coin hunters.

What is AFK Mode in Bloom sniper bot ?

AFK Mode lets Bloom trade automatically using social signals. It can detect Twitter posts, reposts, and even images with contract addresses, then execute buys in real time.

Is Bloom trading bot non-custodial?

Yes. Private keys stay encrypted locally in Telegram’s storage. Bloom never asks for seed phrases.

Does Bloom Telegram bot offer cashback or discounts?

Yes. Traders can reduce fees through cashback rewards and referral bonuses, which grow as you trade more or invite others.

Can beginners use Bloom sniper bot safely?

Yes. The bot is designed with big buttons and clear menus, plus safety toggles like Rug Protection and MEV filters. Still, sniping always carries risk.

You might also like :

- SolTradingBot Review

- Maestro vs Trojan Bot

- Trojan Telegram Bot Review

- Bonkbot Telemetry Review

- Maestro Bot Review

- Trojan vs BonkBot vs Maestro: Best Bots Solana Compared

- Solana (Wiki)

- Solana (Investopedia)

About the author

Learn more about us or contact us